Tuesday February 7, 2017

Economic Calendar & Watch List

Morning Notes

US Futures are drifting slightly lower while European stocks are trading higher after Blackrock, a large global investment firm boosted their rating for Europe to “overweight.” Asian stocks settled mostly lower.

Technicals

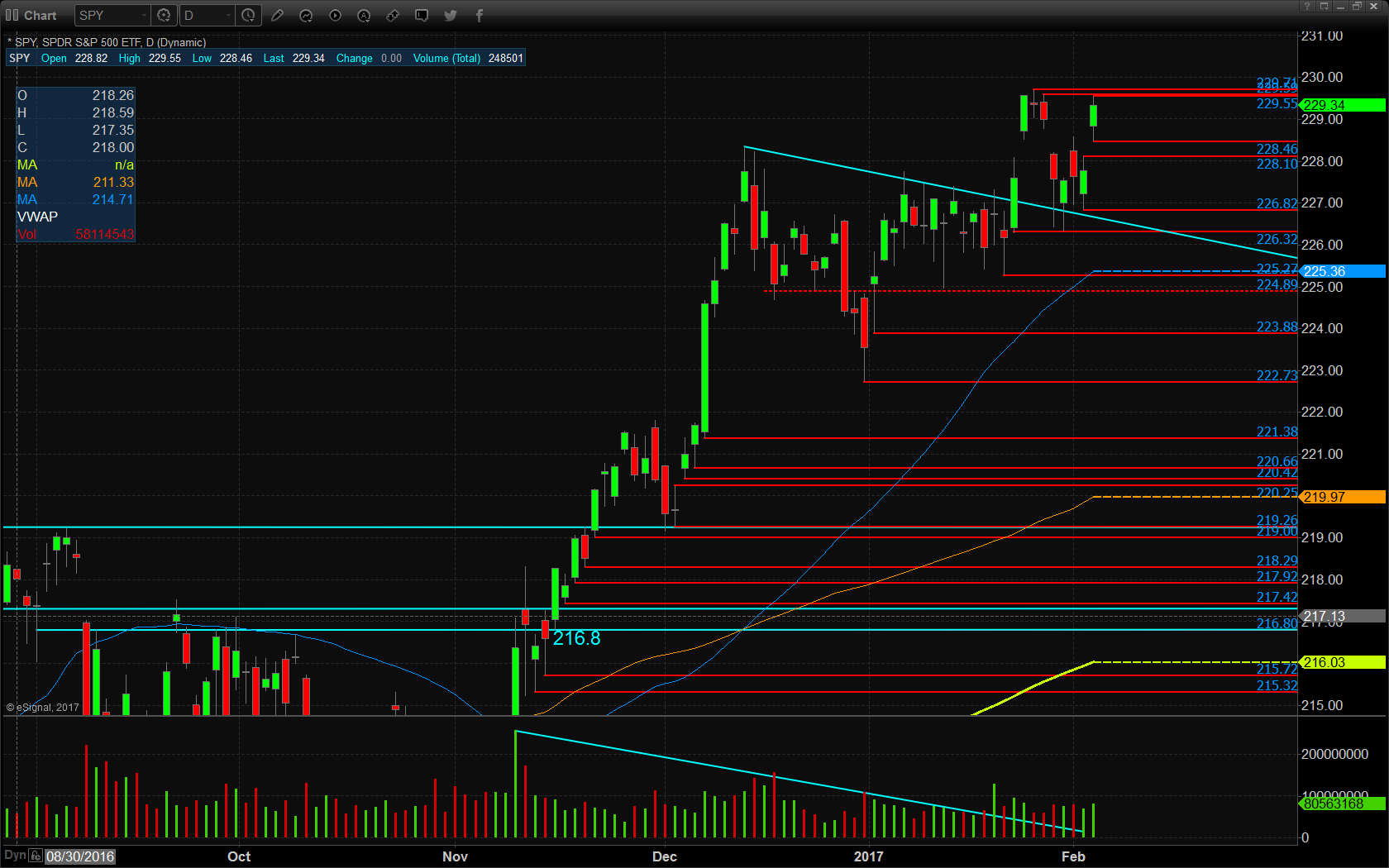

The SPY consolidated throughout yesterday’s session, trading in a narrow range. Support will lie at the low of yesterday’s range at $228.54, followed closely by $228.46, $228.10, $226.82, the former descending resistance of $226.60, then $226.32, and the 50 day moving average at $225.53. Resistance will lie at the high of yesterday’s range at $229.33, followed by $229.55, $229.59, and record highs at $229.71.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$KORS

Economic Calendar

10:00 JOLTS Job Openings Est. 5.56M

3:00 Consumer Credit Est. 20.3B

Notable Earnings Before Open

Archer Daniels Midland (ADM) – EPS Est. $0.78

BP plc (BP) – EPS Est.$0.16

Cardinal Health (CAH) – EPS Est. $1.23

GW Pharma (GWPH) – EPS Est. -$1.69

General Motors (GM) – EPS Est. $1.17

Michael Kors (KORS) – EPS Est. $1.63

Spirit Airlines (SAVE) – EPS Est. $0.74

The Mosaic Company (MOS) – EPS Est. $0.13

Notable Earnings After Close

Akamai Technologies (AKAM) – EPS Est. $0.68

Buffalo Wild Wings (BWLD) – EPS Est. $1.32

Disney (DIS) – EPS Est. $1.50

Gilead Sciences (GILD) – EPS Est. $2.61

Nuance Communications (NUAN) – EPS Est. $0.35

Take-Two Interactive Software (TTWO) – EPS Est. $0.95

Twilio (TWLO) – EPS Est. -$0.06