Wednesday February 8, 2017

Economic Calendar & Watch List

Morning Notes

US Futures are pointing slightly higher this morning while European stocks also trade higher, yet gains were muted after German December industrial production fell sharply lower by the most in 8 years. Asian stocks closed mostly lower.

Technicals

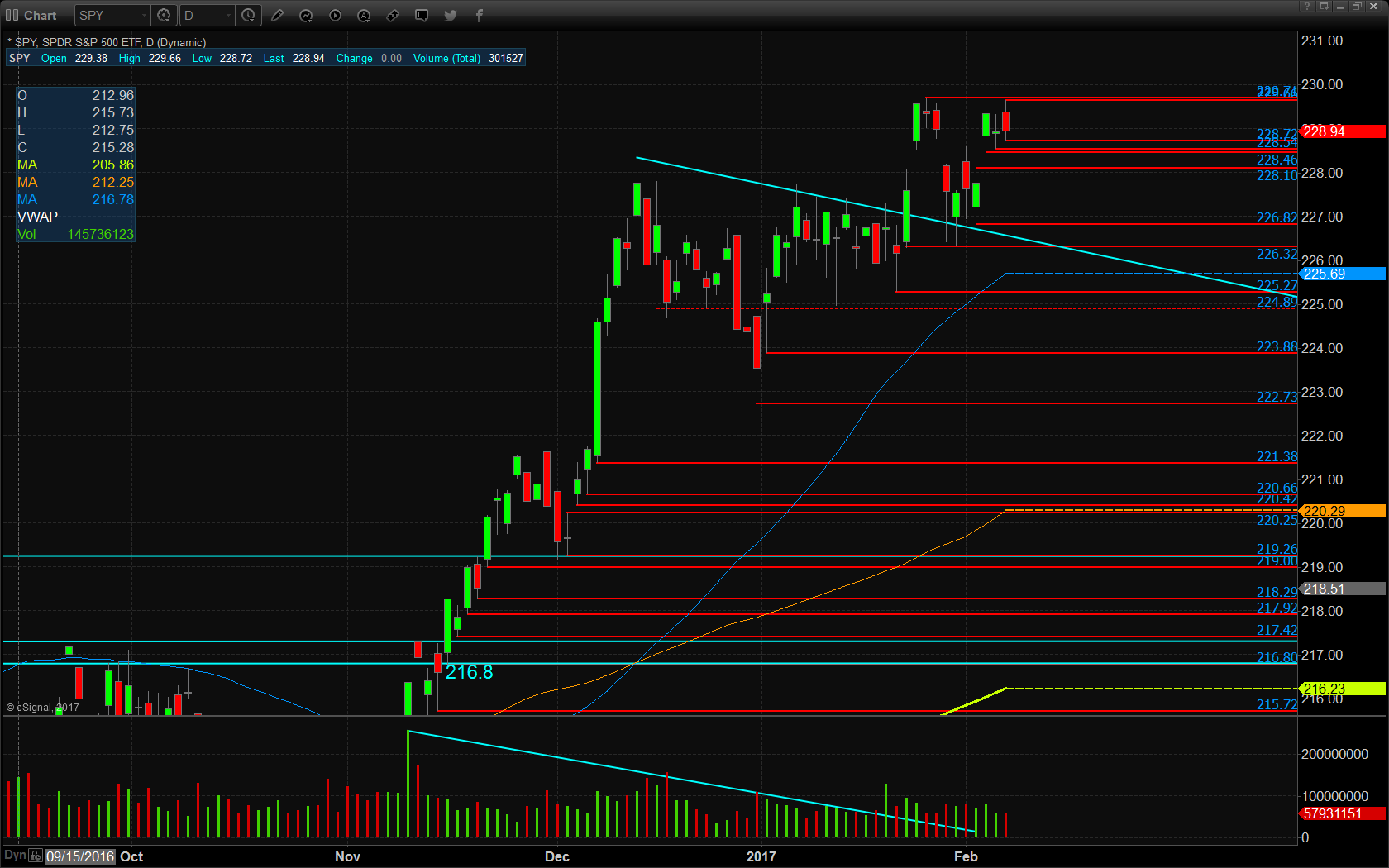

The SPY remains in a tight, choppy range making for a lack of follow through in the majority of stocks. Support will lie at the low of yesterday’s range at $228.72, followed by $228.54, $228.46, $228.10, and $226.82. Resistance will lie at the high of yesterday’s range at $229.66, followed by record highs at $229.71.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$MCHP

$GILD

Economic Calendar

10:30 EIA Weekly Petroleum Status Report

Notable Earnings Before Open

Alaska Air Group (ALK) – EPS Est. $1.40

Allergan (AGN) – EPS Est. $3.76

Goodyear Tire (GT) – EPS Est. $0.87

Grubhub (GRUB) – EPS Est. $0.25

Humana (HUM) – EPS Est. $2.05

Time Warner (TWX) – EPS Est. $1.19

Notable Earnings After Close

Whole Foods Market (WFM) – EPS Est. $0.39

iRobot Corp. (IRBT) – EPS Est. $0.41